Solution

Central to our solution is an intricate Venture Capital Semantic Model. This model elegantly blends first-rate financial data with a curated set of metadata, collected throughout the execution of vital fund processes like investor onboarding, investment valuation, and liquidity monitoring. With this approach, we guarantee a holistic, precise, and timely depiction of your venture capital operations.

Features

There is software that requires you to change your processes to fit the software and there is software that adjusts to your processes. With a highly generic data modell and workflow engine VC Bricks can be tailored exactly to your needs!

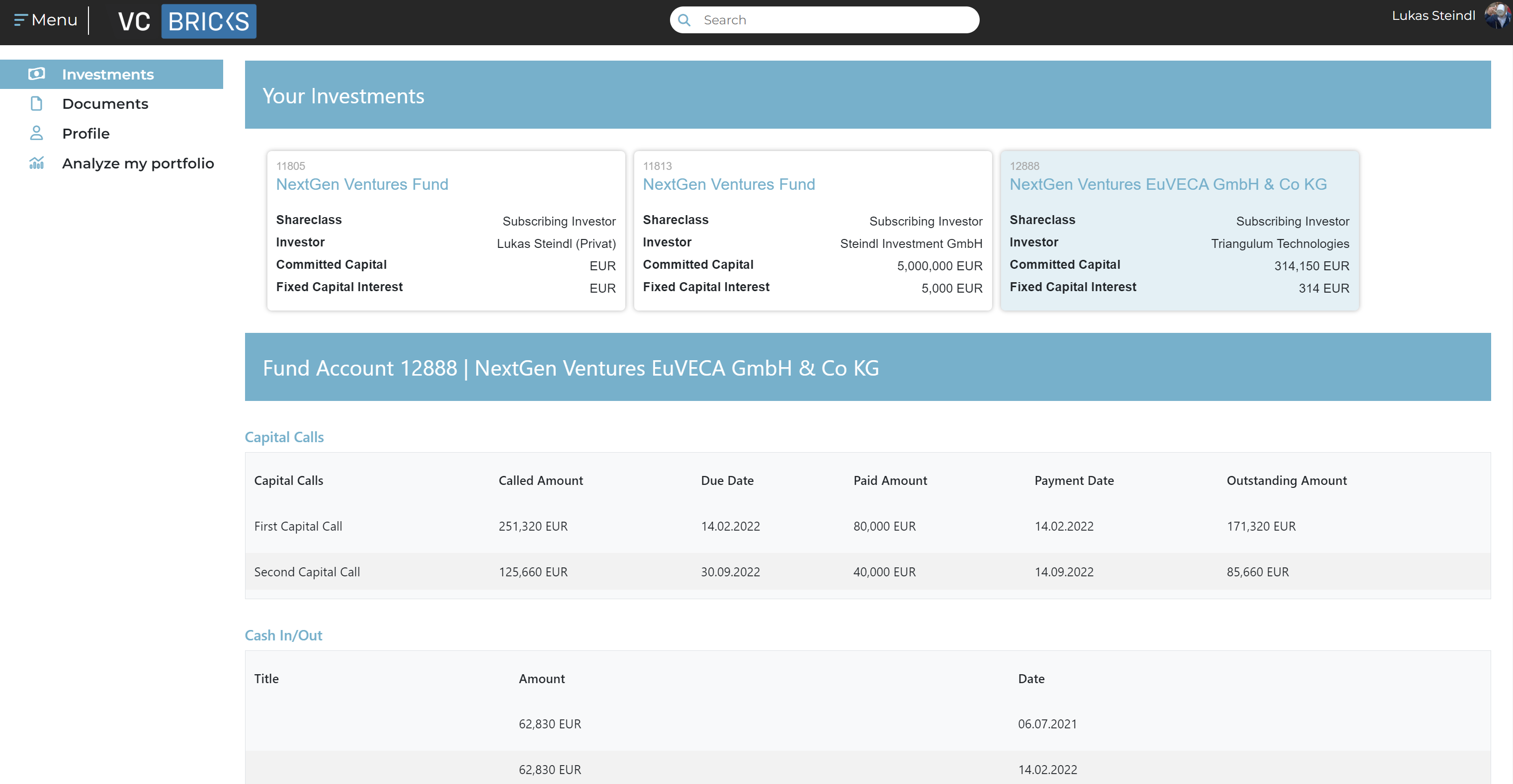

Investor Portal

- Investment Details

- Capital Call History

- Secure Document Distribution

- User Profile

Reporting

- Export To Excel, PDF, Word, HTML, XML, etc.

Document Management

- Upload and share Documents with all Stakeholders

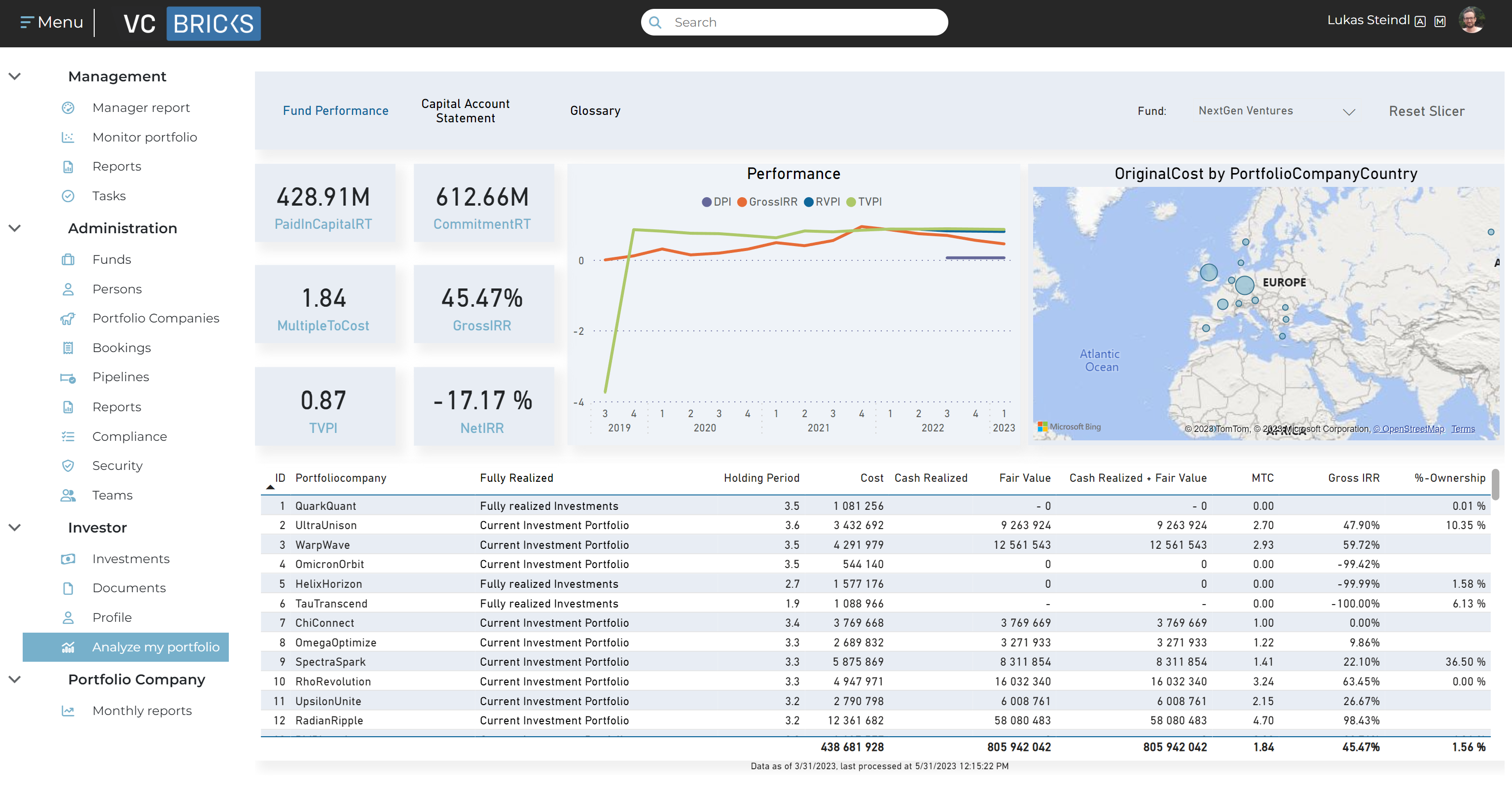

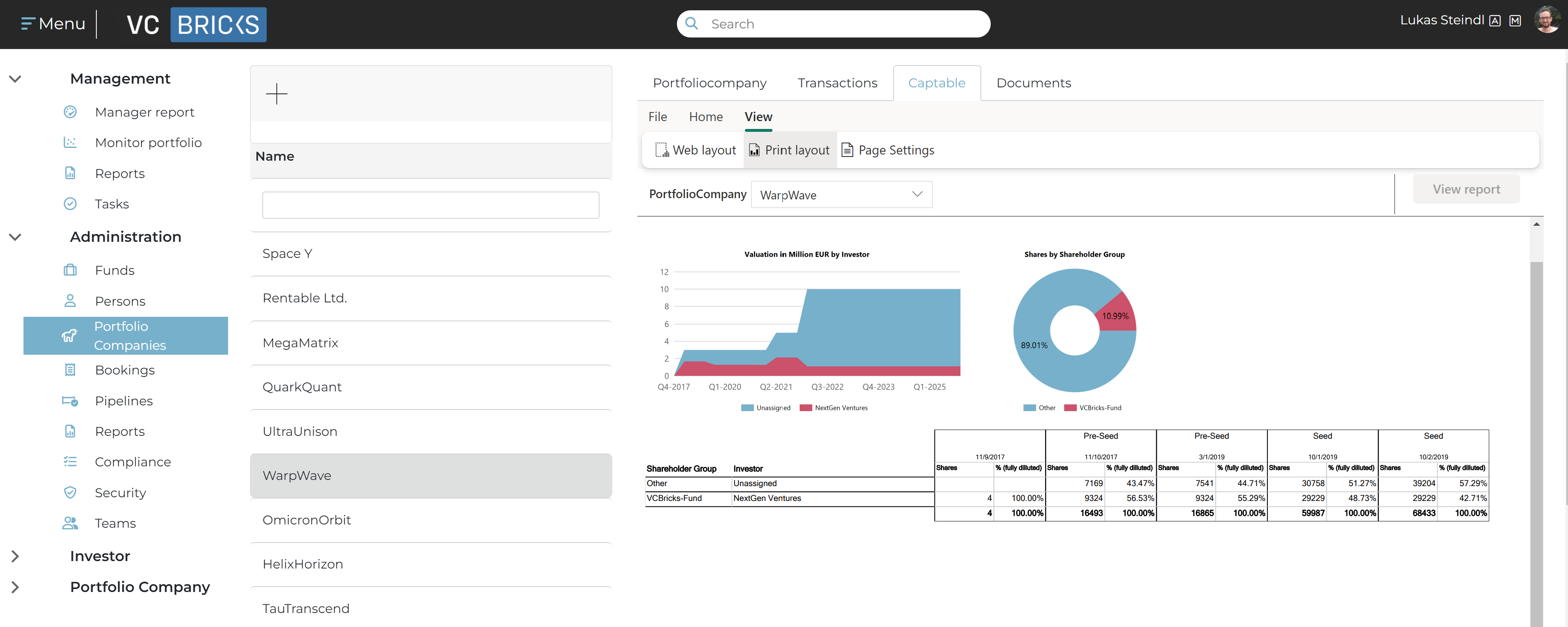

Portfolio Monitoring

- Collect and monitor portfolio company metrics

- Captable modelling

- Scenario modelling

Workflow Engine and Monitoring

- Integrated Quarterly Valuation and Commenting Process

- KYC Data Validation

Comprehensive data model supports complex financial analysis

- Highly flexible and scalable BI Platform building on top of Microsoft`s Power BI stack

State of the art Security

- Building on Microsoft Active Directory B2C

- Support for Social Identity Providers (LinkedIn, Google, Microsoft, Facebook, etc.)

- Multifactor Authentication Support

- Hierarchical Role based Security Model supporting granular access control

- Cell Level Auditing

Contact us for a Demo!

office@vcbricks.com